My investments in 2025 so far

Date:

I thought I'd make a casual blog post and talk a little bit about the investments I have done in 2025 so far and how they've turned out. I guess sometimes talking about our finances is a bit of a faux pas, but I don't really care about it that much and I think it's an interesting topic. Secondly, I am obviously not a financial advisor and none of what I say is actual financial advice, just my personal look at things.

In general, I live a fairly Spartan lifestyle - most of my money goes into either my savings or investments and I generally only buy the things I really need. For example, even though I use a computer daily, it's not some top of the line rig, but rather a setup with a Ryzen 7 5800X (OCed a bit and with a budget AIO, but still) and an Intel Arc B580, by all accounts pretty mid or entry level hardware. I did end up upgrading to RAM that's a bit faster at 3600 MHz and also had to move over to an NVMe boot drive, but that's because the old SSD I was running on melted. There will be a blog post about this later, but my expectations are that this exact setup will last me until 2030. Similarly, I don't really wear designer clothes or even have a car and most of the games and other entertainment I enjoy is also somewhat budget oriented (like buying games on a Steam sale a few years after release).

Why live frugally? Because my expectations are that the economy won't always be in a very good state and I generally value the ability to not stress over what I will do financially next month or even year more than I do about having a lavish lifestyle. Secondly: I live in Latvia and as a consequence most people here, myself included, aren't doing amazingly financially. You can compare the average developer salaries in Latvia with either the rest of the EU or even US and weep for me. There's of course the ability to start your own business, but my risk tolerance is a bit too low for that, so I generally look for ways to invest money without doing too high risk investments, nor let inflation eat it all up.

And it doesn't end with just me. If my parents or even friends need that sort of a help, I'm happy to be able to help them - for example, one of my friends ended up with a cancer diagnosis and while she's undergoing chemo, she can't really work and in her part of the world the treatment itself is covered by insurance, but it's not like the world around her just stands still and she couldn't really cover everything without a bit of help. Where governments and the systems around them fail, people have to just pick up the slack.

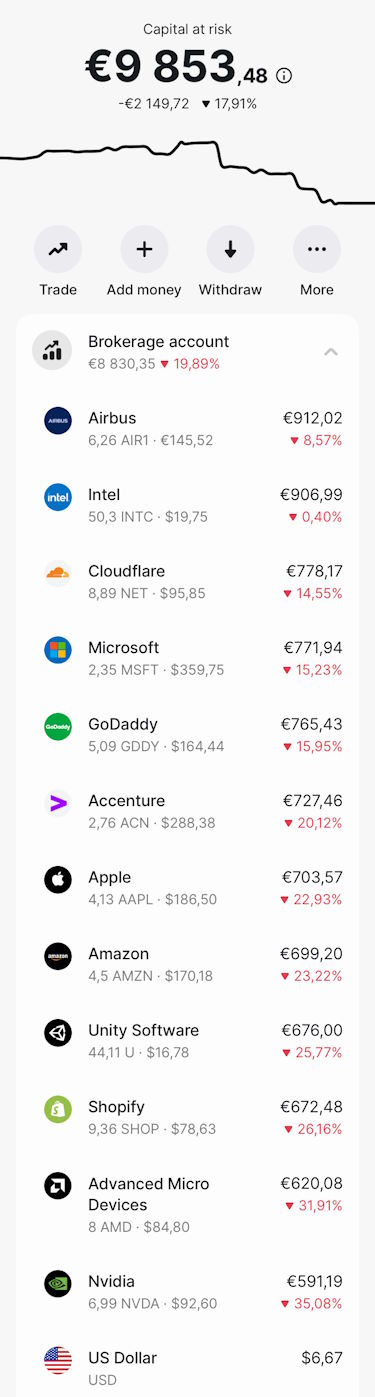

But back to the investments, in the January of this year, I put around 14'000 EUR into a bunch of different investments through Revolut. I'm not really advertising them, but it was one of the easier ways for me to put my money into individual companies. Meanwhile, most of my other investments are handled by my bank, SEB, with various sector funds - less volatility, but also less in the way of profits, or at least the potential for profits. The idea here was to also be able to compare how things have performed in the last 10 months at the end. With that out of the way, let's see what groups of companies and companies (as well as crypto and commodities) I put my money in, and how it turned out!

Tech companies, OSes

I went for a lot of tech and tech adjacent investments. The first group that I thought of were companies that have their own OSes (and sometimes hardware). Why? Because they don't have a crazy amount of competition, getting into that space is pretty difficult and yet everyone has a computing device of some sort.

Apple

A long while back, I ended up getting a MacBook Air and an iPhone SE for a freelance project and I have to admit that both the software and hardware are quite good! With macOS also having way more of a market share than Linux, it felt like a pretty good investment:

Sadly, I appear to have been wrong about this, because their stock price has been more or less stagnating for most of the year. While their chips and the build quality of their devices are still pretty much amazing, it seems like the industry does not share my positive outlook, at least in a way that'd matter. I guess the launch of their Liquid Glass design also wasn't anything that'd wow people, but at this point I'm not sure why most companies do some pointless redesign every few years, when things already work okay.

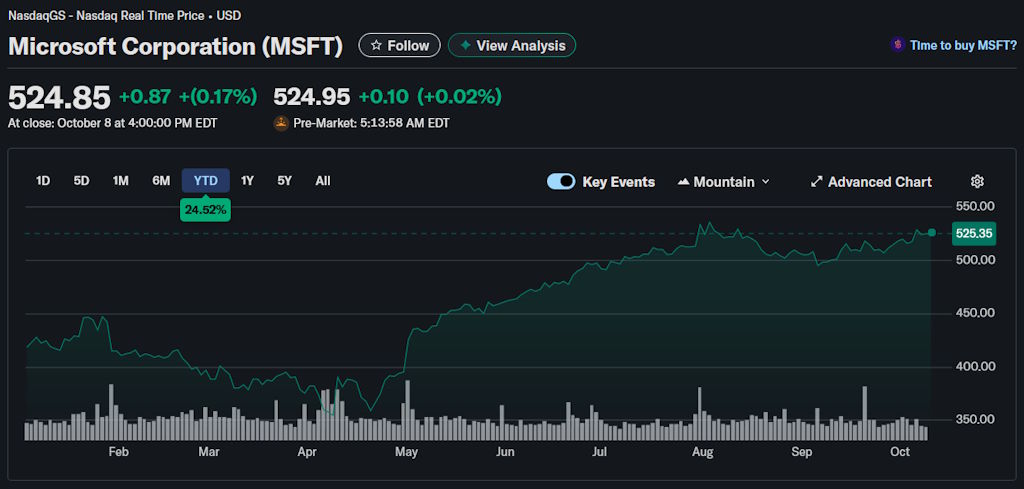

Microsoft

Microsoft is also very much guilty of the same kind of faffing about and recently announced that they are making having offline accounts harder, which I think is fairly stupid, user hostile and generally a bad move, alongside them consciously sometimes ruining what could be a good OS, alongside underwhelming services like Teams, yet it seems that they did better somehow:

I couldn't tell you why they did that much better, seems like things went upwards after they posted their earnings, but at the same time they had a lot of layoffs, shifted focus to AI and are still pushing a lot of Office 365 services. When you think about it, it's kind of upsetting that taking away the livelihoods of thousands of people is described as "savings".

Tech companies, CPUs & GPUs

I also decided to invest into companies that make their own hardware: CPUs and GPUs in particular. Again, it's a case of those largely just being too big to fail despite any sorts of bad product launches or trends of stagnation. You can be pretty much sure that there will be bailouts if it's within the strategic interests of some of the largest governments in the world.

NVIDIA

The first idea was to go for Nvidia. I don't really like them as a company much, because their drivers on Linux aren't known to be great (yet remain the best option for hassle free enjoyment of games on Windows), though are more or less printing money due to the AI boom that we're in the middle of:

The overall trend is positive and they did make YTD +40% but the issue is that I'm a bit late to the party. The bubble hasn't quite popped yet and we're not in a financial crash, but even if I can make a profit off of the state of things, it won't be as much as those that bought in early:

As usual, luck isn't fully on my side and the right time to invest in Nvidia might have been somewhere in 2023, before they got really big. Imagine if instead of 40% profits I had instead made over 1000%. But hey, I don't think anyone could have predicted just how big AI has gotten (sometimes undeservedly so).

AMD

Now, AMD is a bit more of a darling company. Despite their pricing strategy for their consumer products sometimes being "Intel - 50 USD", or them never missing a chance to miss a chance (just look at how their ROCm struggles to catch up to CUDA), at least they're trying to provide viable alternatives to the overpriced Nvidia and often power hungry Intel. Their Ryzen chips are still some of the best you can get.

Unfortunately, their stock prices were stagnating for most of the year, however very recently saw a significant jump:

All of that actually came from a recent partnership with OpenAI, where AMD will ship them a lot of GPUs. It increasingly feels like for all of these companies, the consumer segment is close to a rounding error, but if it gives them more money to work with, I guess I should cheer them on. Maybe in a few years ROCm will also be good and honestly if the RX 9060 XT 16 GB GPU supported 4 monitors instead of just 3, that'd probably be my next upgrade from my Intel Arc B580 (or whatever would be the next series that's out by 2030).

Intel

Now Intel's a bit of an odd one. I largely decided to invest in them both because they're too large to fail, even after throwing Pat Gelsinger out and their new CEO largely saying that they won't even try to be competitive, and the blunders of the 13th and 14th gen, as well as the somewhat disappointing Core Ultra launch, as well as layoffs... actually, there is so much wrong with Intel, yet somehow they're doing BETTER than Nvidia from the lows:

In this case, it definitely was a higher risk investment that paid off, even if you zoom out and look around, it doesn't reflect all that well on the long term performance of the company at all:

A part of my decision to invest in them might have been the fact that their Intel Arc GPUs provide some much needed competition to the other companies. A part of it is the understanding that if they go under and the only serious manufacturer of x86 chips becomes AMD, then they'll stagnate similarly if not worse than Intel did, because there will be very little preventing them from cranking up the prices.

But a part of it is the understanding that maybe they could be a good company if they stopped shooting themselves in the foot at every opportunity, worse than AMD does. For example, their Core Ultra 285K chip came out at a price of 589 USD. By all accounts, despite the new architecture and lower power consumption, it was more or less a sidegrade - sometimes being outpaced both by their prior 14th gen chips (that had really high power consumption and ran hot), as well by the current AMD chips, despite otherwise scoring pretty well in various productivity benchmarks.

You know when most consumers wouldn't have been angry at them? If they competed with AMD on price: their 9800X cost 499 USD on release and their 9700X cost 359 USD. What if Intel stopped being delusionally greedy and released their new CPU at a price of 480 USD? Ask yourself, what is better: to make less profit, or to sell no chips at all? Suddenly, there'd be a new platform that's really good at productivity, okay at gaming, has good power draw and thermals... and they just didn't do that.

Services companies

The next group of companies, and perhaps the largest, that I invested in were various services based companies. Sometimes they offer web related services, other times it's about e-commerce, game engines, or even consulting. Even if I can't predict the future, I can at least diversify enough to make most individual failures (short of an economy collapse) tolerable.

Shopify

First up, I wanted something kinda "legacy" - an established company that's been around for a while, that I've heard of even if I don't use their services directly a lot. Shopify fits the bill and in general did pretty well:

GoDaddy

Another such company was GoDaddy, they do a bunch of web hosting, sell domains and so on. There's lots of other companies like that out there, I've personally moved from NameCheap and Porkbun over to INWX because I wanted something EU based instead. But as far as publicly traded companies go, they seemed like a safe bet. Surprisingly, I was wrong:

Who knows, maybe I should have left the investments alone for a few more years, but it seems that their value actually peaked around the start of 2025 and if I sold now I'd basically be doing a "buy high, sell low" strategy, which is not really what you want to do:

In other words, it might actually be a good idea to keep the investment there and see whether they can recoup the value... or maybe they'll just stagnate and never recover, who knows. I can't really think of that many news with them recently either.

Cloudflare

On the complete opposite end of the spectrum, Cloudflare seems to have done amazingly this year so far, they actually had the most increase in stock value out of all my investments! My rationale for picking them is that they're also largely too big to fail and are too entrenched in the structure of the Internet at some point, providing a bunch of services for an ever increasingly large part of it, to the point where they've been critiqued as holding it hostage in a way.

Regardless, their figures are great:

I'm now pondering whether I should just sell and cash in, or wait for a bit longer and see what happens.

Accenture

I also wanted a company that does software development for others, more or less an organization that does consulting. Accenture fit the bill and I thought that they have a lot of government contracts and such despite their occasional bit of controversy, but I'm not really here to talk about their ethics, or even the idea of consulting in general, vs just building the damn software in-house.

A part of picking them was that they also have a large presence in my country, over here in Latvia we don't really have a strong software development scene with investors and such, so what ends up happening is that a lot of the work you do get is basically being a body shop of software devs that write code for large multinational orgs and make pennies on the dollar. Not a dignified existence, but hey, it pays the bills.

I've actually personally seen some investors look at a Latvian startup that wants to compete with Bolt, decide that they want a higher likelihood of success and the whole initiative dying in the water then and there, while it could still be developed for peanuts, compared to what would be needed with your typical unicorn in SV.

If we can still build software and can do so way cheaper than in the US, then why do we get relegated to doing mercenary work instead of attracting actual investments, having a good tech scene and propping up the economy in ways that would sure as hell be more useful in the long term than some AI bubble!?

Anyways, I digress, here's Accenture:

They kinda bombed. That said, their stock prices have been volatile for years:

More so than with the other companies, actually. I guess if I keep the investments in them for a few years they might as well bounce back, since I feel like they still very much fit the bill of being too big to fail.

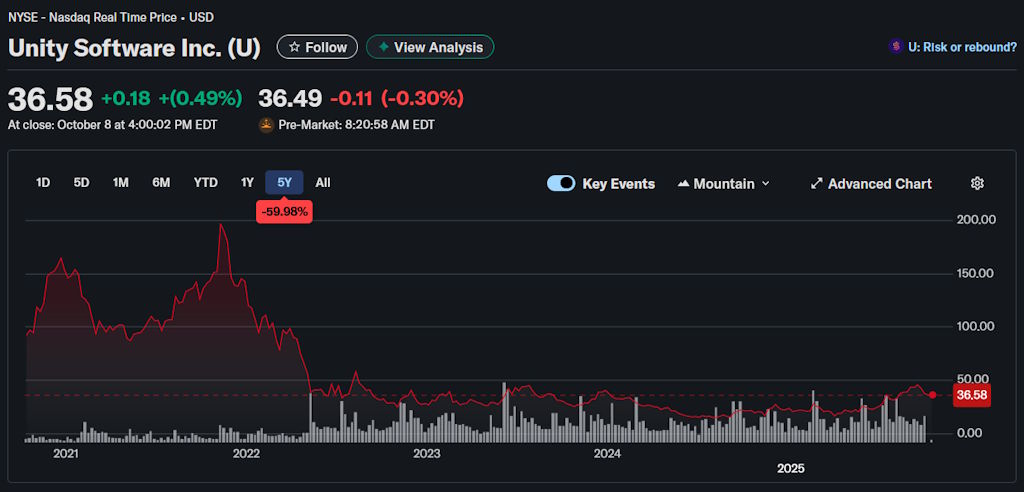

Unity

Unity's an interesting one!

I hate Unreal Engine with a passion because it's ruining games with their horrible unoptimized technology that makes most hardware out there struggle a lot and at this point both upscaling and framegen are necessary to run the slop games that studios put out, while trying to gaslight gamers about their bad games somehow actually supposedly being good and it being people's eyes that are wrong.

Fuck that engine, fuck that trend, fuck the developers saying that crap, get out of here. Instead of people online ranting incorrectly about how inclusion or whatever is ruining games, the real stuff ruining them is right under your noses - studios prioritizing being able to ship faster instead of optimizing games properly or picking reasonable tech, like an extreme case of Wirth's law, except mandated by a bunch of managers.

So, Unity is not Epic and that's reason enough to like them at least a bit. The underlying tech has historically been pretty good, they support a lot of devices, from mobile phones to consoles and desktop platforms (and even web), the engine is nice to use and uses a sane language like C#, has a frickload of assets available in a store and historically has resulted in both a lot of bad games (because of how easy it is to make one), as well as pretty notable hits, which shows in their stock price:

Except no, I'm kind of lying here, look at the last 5 years:

While the tech itself has been pretty okay, the org behind it has been plagued by all sorts of issues. From Gigaya being cancelled, which was supposed to be a full game that shows how to make good stuff with the engine - imagine what sort of a message that sends "Oh yeah, literally impossible, so we cancelled it.", to technological things like DOTS being half baked for the longest time, and them stumbling about with their render pipelines and largely the feeling being that they don't know what they want the engine to be, leading to a lot of half baked functionality that almost sort of works, but not really.

Add to that their merger with IronSource which drew a lot of negative press, alongside their Unity Runtime Fee which is now cancelled after literally everyone dragged them through the mud, all the way to their CEO being fired because of it.

But the thing is, much like with Intel, everyone is wrong. Why? Because even back when the Runtime Fee happened, I wrote plainly that it was just a badly concealed sales funnel - all of those extreme numbers that people had outrage about would have gone away if you'd just upgrade to their higher subscription plan, even aside from how stupid the idea of the runtime fee was and how bad their messaging around that was. What ruined them wasn't just being greedy, it was the community having the worst possible interpretation, content creators chasing drama and blowing it out of proportion and the company might never recover from that.

Instead, the engine genuinely could be good and more or less be the "default" engine for the next decade, much how Blender is more or less the default 3D modelling program outside of either legacy or niche orgs (most gamedev studios kind of fitting that description, what an odd world). Their 3D support infinitely more mature than the likes of Godot and doesn't run like crap like Unreal does, they have the asset store, the docs, the examples and the overall ecosystem. If they just locked in for 5 years and did good work on the core tech, things would be good.

But of course, in reality, they'll probably be about as greedy as Intel, because we can't have nice things. For all I know, the company might as well be in a slow death spiral and we'll all need 300W GPUs to just run the latest Unreal games with upscaling from 720p and framegen from 30 FPS.

Amazon

Then there's Amazon:

I don't really have much to say for them, aside from the fact that I thought that they'd do better by kissing up to the current US administration. Guess not quite, go figure.

Airbus

I also picked Airbus and after the US election results maybe should have invested more heavily in EU companies (though oddly enough I couldn't find AIR1 on Yahoo Finance, though AIR.PA did similarly well), but they had a pretty nice performance overall:

Commodities

I also saw the fact that Revolut allows you to trade in commodities like gold or other rare materials, except there very much was a disclaimer about it being quite unregulated. That said, I decided that since I'm doing 1000 EUR (or in the case of US stocks, 1000 USD) per one investment, I might as well risk some money on those as well.

Gold

For that, I picked gold, which is the only thing that has been more or less consistently going up, maybe aside from the Cloudflare investments:

I wonder how it will look in a year, I might also keep this investment around, since I'm not sure what should happen in the world to make gold lose its value. Oh yeah, since I'm not doing screenshots of the Revolut app (for whatever reason, they won't run well in a landscape orientation on my iPhone), I looked up the data in another website rather than Yahoo Finance, since they didn't let me find Gold prices. This does seem to more or less match what's in Revolut, though, so good enough.

Crypto

Now, if I'm comparing as many ways of throwing your money into the void and hoping some of it comes back out, I did also decide to do some crypto investments. I guess like with many things, I have a bit of an utilitarian stance when it comes to it. It's an okay way of making payments without involving the banking system too much (or middlemen like Wise when doing transfers across the borders, like why the hell should I give up so much of the money I want to send to a friend to some company for just using their service) and some cryptocurrencies could be a deflationary means of storing assets... but in practice also carries pretty great risks and high volatility.

At the same time, there's a nearly infinite amount of rugpulls, that at this point I'm not even sure whether they're money laundering, a way to take bribes out in the open, or just profit off of stupid people, look at stuff like this:

In my case, I went for some regular crypto coins that are more mainstream, I didn't intend to speculate a lot but rather take the "hodl" approach and just put some money in a wallet on chain, make backups of said wallet and see where it all is in a year or ten.

Bitcoin (BTC)

My first choice was Bitcoin. I briefly looked at Bitcoin Cash, which was an older project that also attempted to have low transfer fees, but with the Lightning network mainstream Bitcoin no longer really has that problem and BCH has largely been displaced:

Overall, this went both a bit better and a bit worse than expected. Better, since there wasn't a frickload of volatility and I didn't end up with no money whatsoever. Worse, because there also weren't any significant profits, either.

Actually, by now you've probably noticed how near the April pretty much everything crashed. It was largely due to the tariffs that Trump announced and what the administration did to the economy. Personally, I'm not even sure whether it was an attempt at throwing things off balance so their rich buddies could capture even more of the wealth both in the country and the global economy, an attempt at strongarming other nations, including the EU, to trade on terms that are more favorable to them (no, we don't want their cars), or a perverse mix of both.

In the end, however, what I got was instead of describing a bit of gradual growth with some events that lead to more profits, was a massive dip in pretty much everything in the middle. Imagine opening up the app and one day seeing this:

Put plainly, I don't like that administration, I don't like what they're doing with the social fabric of the country, I've heard from my trans friends that it's no longer safe for them there, nor do I think it's safe for anyone who looks remotely Mexican, or even anyone who wants a democratic country instead of a dictatorship. They were supposed to be a partner nation to the rest of the West, instead they do things like withdraw from the Paris Agreement, mock NATO, try to screw over our economy and are basically good for nothing. The post I wrote about what things might look like by 2030 has predictions more or less coming true... except we're still just in 2025.

It was inevitable that this would have some politics in it, but the takeaway here from the image above is that even crypto is not immune to those sorts of shifts - see the dip in price even against Euro, at the time of the tariffs? In other words, if we end up having another crash like in 2008, be it due to AI or something the administration pulls, it's likely that crypto investments won't be some panacea either.

Ethereum (ETH)

I also did some Ethereum investments because way back they seemed like a cool project with the potential for all sorts of programmatic use cases:

Right now, however, they didn't perform much better or worse than Bitcoin. As with most crypto (that survives for years and isn't a rugpull), it very much feels like the earlier you get in, the better things will be. I guess the same applies to rugpulls as well (get in and out before the "pull" part), but in general I'd much prefer most of my investments to be in companies that actually make stuff.

Personal preference, though. There is definitely some strength in a diversified portfolio.

Summary

To sum it all up, I was actually thinking about how best to visualize the data. I recently moved over to using OnlyOffice instead of LibreOffice, because I found out that the software package is actually made in Latvia, so I was pretty curious to try it out!

I will say that it looks nice and is quite pleasant to use, but definitely they're not a dedicated data visualization solution, the charts are easy to create but not super advanced. Either way, without jumping into writing code, I managed to find a type of graph (radar chart) that was pretty useful for what I'd like to show:

The red shape is the starting price of each investment in EUR (some were 100 EUR, others were 1000 USD, so a bit less), whereas the green shape is how much money each of the investments made, loosely in the same order as described above.

I haven't seen this visualization be used for this type of dataset that often, but I think it's pretty useful - where red is above green, I'm losing money, whereas the polygon reaches out the furthest away from the center, the highest the current value is.

Here you can very much see, that the most profitable investments ended up being:

- Cloudflare: 1681 EUR

- AMD: 1633 EUR

- Intel: 1622 EUR

There were also some in the middle that performed pretty decently:

- Unity Software: 1380 EUR

- Shopify: 1336 EUR

- Gold: 1279 EUR

There were also some that made a profit, but not that much at all:

- Bitcoin: 1160 EUR

- Ethereum: 1160 EUR

- Nvidia: 1146 EUR

- Airbus: 1105 EUR

- Microsoft: 1062 EUR

And then there's some that just lost money:

- Apple: 915 EUR

- Amazon: 866 EUR

- Accenture: 597 EUR

- GoDaddy: 589 EUR

You'll notice that some of those figures are a bit different from the images above, but that's because this data is straight from Revolut and also based on currency conversions as necessary, plus some fees apply. Either way, that should be enough to demonstrate the principle. I might have also sold some of the crypto along the way, but this is how it'd look if I had held onto it.

In general, I think that investing is a good idea, since it can help you prevent your assets by being eaten up by inflation, if you don't intend to spend all of that money. Investing into individual companies carries higher risk than just sector funds, whereas crypto and commodities will probably be similarly hit or miss. I'd say it all depends on what your risk tolerance is like.

As for what to do now, I'll probably keep the money in there and see whether I need to sell the investments at some point. As I said, it's there primarily for a rainy day, though I did splurge on a 35 EUR mechanical keyboard recently (yeah, a surprisingly cheap one and with Outemu Brown switches, I hope it's going to serve me well for a while).

As for Revolut, I had a bit of a mixed experience: the app itself is nice, annoys me sometimes with making me confirm my on-chain transactions when I don't want to let them keep my crypto for me, but instead want to transfer it to my own wallet ("suspicious transaction", pffft), and the fact that they display the current prices in either EUR or USD but not in the currency that you originally purchased shares in is a bit annoying. Oh well, they're better than nothing. Sure beats keeping all of my money just in SEB.

Other posts: « Next Previous »